Tax Registration

Corporate Tax Registration Services in the UAE – Ensuring Compliance and Peace of Mind

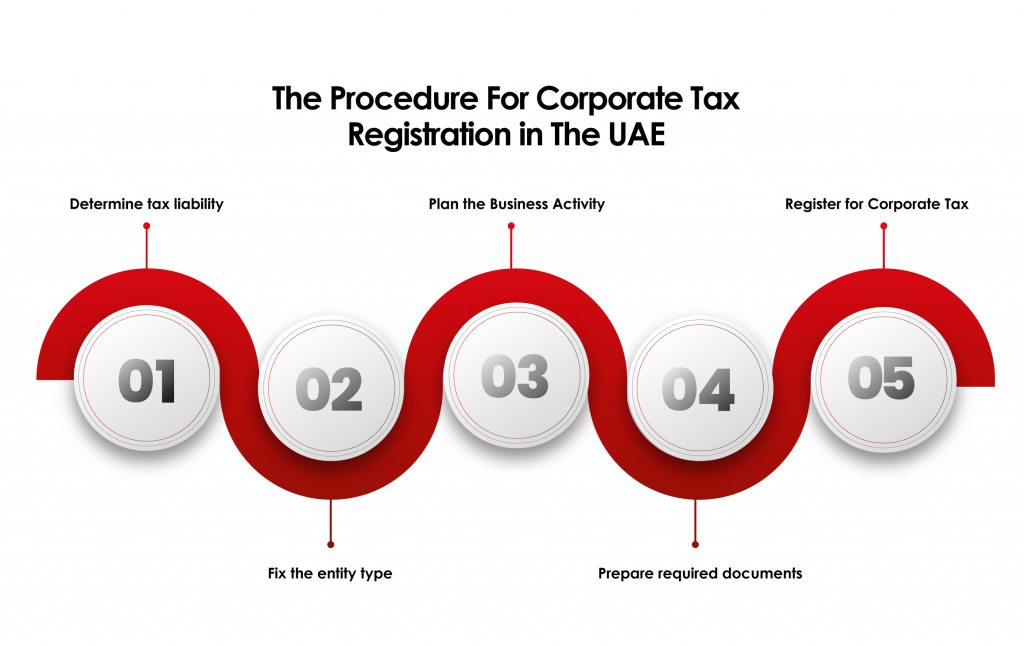

With the introduction of Corporate Tax in the United Arab Emirates, businesses are now required to meet new compliance obligations in line with Federal Tax Authority (FTA) regulations. Whether you operate in the mainland, free zones, or across multiple emirates, corporate tax registration is a crucial step to ensure legal compliance and avoid penalties.

Our firm specializes in providing Corporate Tax Registration Services to help businesses register seamlessly, understand their obligations, and stay compliant with UAE tax laws.

Our Corporate Tax Registration Services

1. Tax Eligibility Assessment

We begin by assessing your business activities, structure, and revenue to determine your corporate tax obligations under the UAE law.

2. Document Preparation & Filing

Our experts prepare and verify all required documents — including trade licenses, company incorporation papers, and financial details — ensuring accuracy before submission to the Federal Tax Authority.

3. Online FTA Registration

We handle the complete registration process through the FTA portal, minimizing errors and delays.

4. Advisory & Compliance Guidance

Beyond registration, we guide you on maintaining proper accounting records, meeting filing deadlines, and understanding applicable tax exemptions.

Why Choose Us for Corporate Tax Registration?

Expertise in UAE Tax Laws – Our team stays up to date with the latest FTA guidelines.

Error-Free Process – We ensure accurate documentation to avoid costly penalties.

Time Efficiency – Fast, hassle-free registration so you can focus on running your business.

Ongoing Support – From registration to annual compliance, we’re with you every step of the way.

Benefits of Timely Corporate Tax Registration

Compliance with UAE legal requirements.

Avoidance of fines and penalties from late registration.

Proper tax planning and financial forecasting.

Strengthened credibility with stakeholders and investors.

Documents Required for Corporate Tax Registration in the UAE

When registering your business for Corporate Tax in the UAE, you need to prepare and submit specific documents to the Federal Tax Authority (FTA) to ensure a smooth and successful registration process.

1. Trade License

A valid trade license for your business (mainland or free zone) showing the nature of activities and validity period.

2. Certificate of Incorporation

For companies, this includes the incorporation certificate issued by the relevant licensing authority or free zone.

3. Memorandum of Association (MOA) / Articles of Association (AOA)

These documents outline the company’s ownership structure and operational framework.

4. Passport Copies of Shareholders & Authorized Signatories

Clear copies of valid passports for all shareholders, partners, and the person authorized to sign for the business.

5. Emirates ID Copies

Copies of valid Emirates ID for shareholders, partners, and authorized signatories.

6. Contact Details

Registered office address in the UAE.

Valid email address and phone number.

7. Financial Information

Most recent audited or management accounts (if applicable).

Estimated turnover for the current financial year.

8. Power of Attorney (if applicable)

If a representative is handling the registration process, a notarized Power of Attorney is required.

9. Business Activity Details

Description of your core business activities, sectors, and locations of operations.

Feel Free To Ask any Question

We would love to hear from you.

FAQ?

A feasibility study assesses the practicality, expenses, and potential risks associated with a proposed project in Dubai. It offers essential insights and guidance prior to resource allocation, aiding in the identification of obstacles, evaluation of demand, financial analysis, and estimation of success probability.

The essential elements consist of market analysis, technical evaluation, financial assessment, legal and regulatory examination, risk evaluation, and analysis of environmental and social impacts.

The expense associated with a feasibility study can fluctuate widely based on several key factors:

Project Complexity: Projects that are more complex and involve multiple components generally necessitate a more thorough study, which can increase costs.

- Level of Detail: The extent of detail required in the feasibility study can affect pricing. A broad overview will typically be more affordable than a detailed examination.

- Engagement of External Consultants: Utilizing external consultants with specialized knowledge can contribute to higher overall costs.

- Costs for a feasibility study can range from a few thousand dollars for straightforward projects managed by an internal team to tens of thousands of dollars for intricate projects that require the expertise of external consultants.

Take into account elements such as industry experience, regional insights, a history of successful outcomes, customized solutions, innovative approaches, team credentials, clear pricing, and support after the study is completed.